Tariffs will disrupt the long-standing flow of nickel between Canada and the US

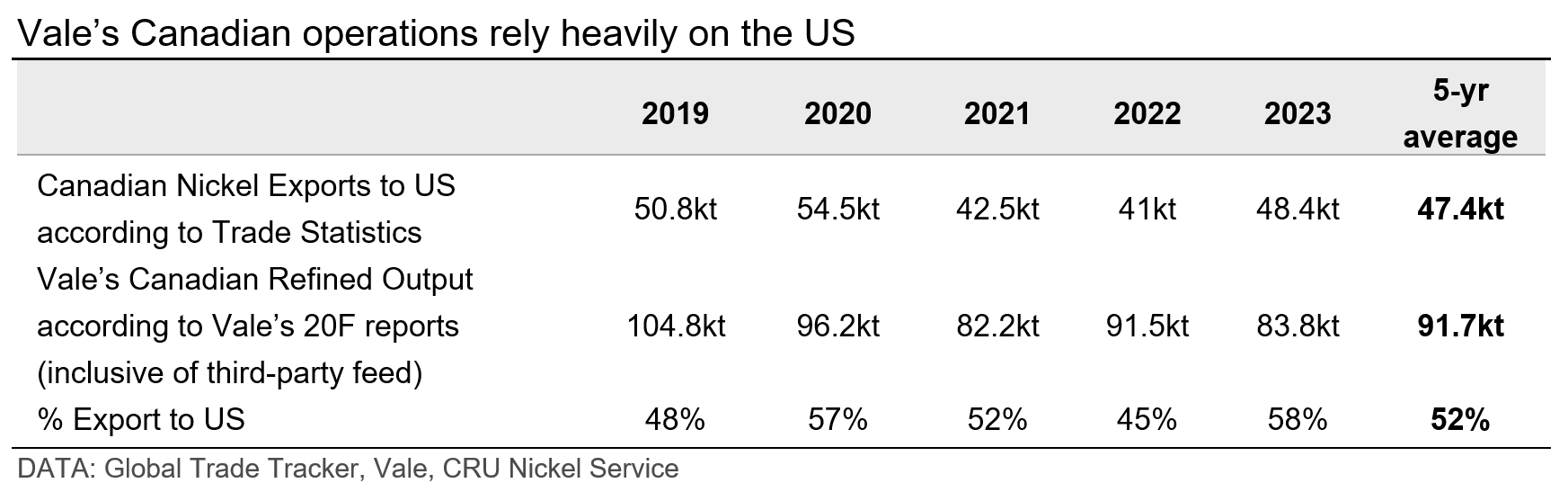

Canada is the single largest supplier of nickel metal to the US market, typically delivering between 35–40% of the United States’ annual primary nickel requirements over the past decade according to trade statistics and CRU’s Nickel Service. However, US President-Elect Donald Trump has announced potential 25% tariffs on Canadian imports, threatening to disrupt the flow of nickel across the border.

This will not only have a negative impact on the Canadian nickel industry, which is already struggling with high costs amid a global market in chronic surplus, but also on the US industry that needs a stable and secure source of high-purity nickel in a world that is increasingly dominated by China.

US market has no domestic nickel industry and is fully reliant on imports

In the US, nickel is largely used to make stainless steel followed by uses in foundry, alloying and plating applications – very little nickel is used domestically in battery applications. When it comes to stainless steel, the US has a mature scrap collection and distribution network meeting more than 80% of stainless-steel nickel requirement. The remainder needs to be secured by purchasing ferronickel or high-purity nickel. For all other applications, high-purity nickel is required.

The US has one operating nickel mine located in Michigan, owned by Lundin. This mine produces a concentrate that is exported, given the US has no domestic nickel smelters or refineries with the capability to process nickel-bearing concentrates. However, this mine is anticipated to exhaust its production by the end of 2025, leaving the US with no domestic nickel industry. As a result, the US will be completely reliant on imports to meet its primary nickel requirements.

Depending on the permanence of tariffs, US domestic nickel refining may become an attractive proposition and there is at least one company with plans to build a carbonyl nickel refinery producing high-purity nickel. However, the challenge this plant will have is sourcing intermediate feed.

Tariffs will push Canadian nickel to other markets

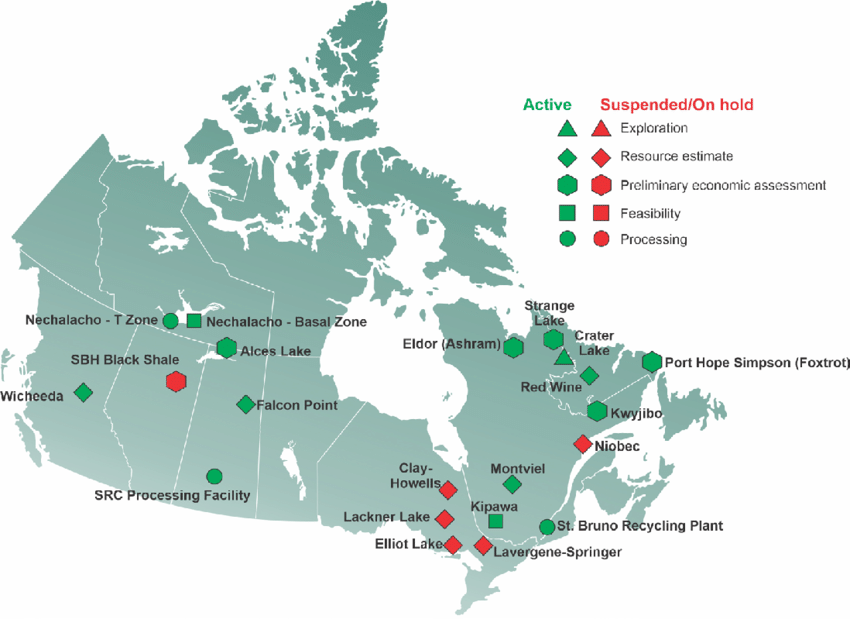

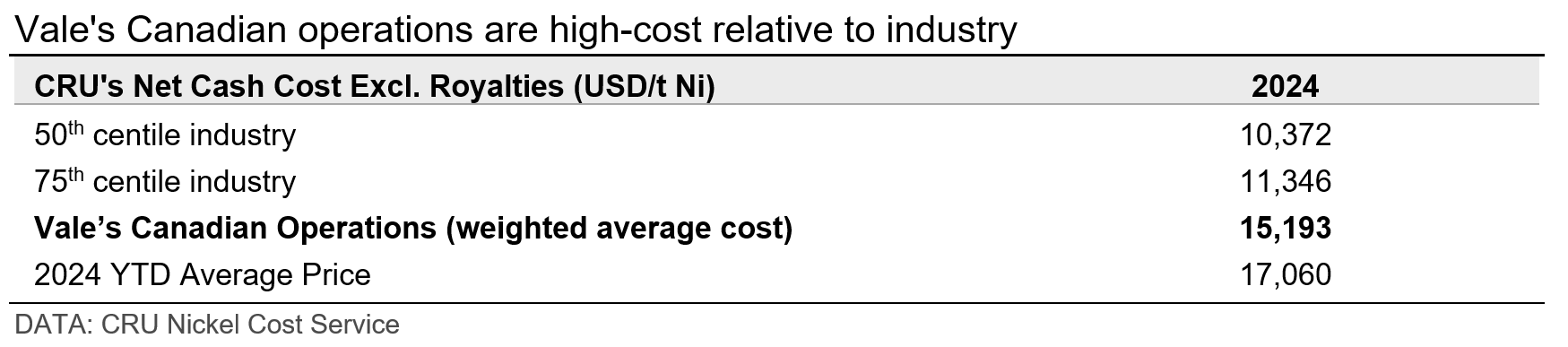

Although Canada is home to several large nickel producers, only one has the right surface assets and ore sources to be able to supply the US market from Canada. Vale produces high-purity nickel from its Sudbury and Long Harbor operations. However, its Canadian assets sit in the third and fourth quartile of CRU’s Net Cash Cost Excl. Royalties Industry Costs Curve.

Despite being positioned near the top of the cost curve, Vale’s operations appear to be able to turn a profit at YTD prices. However, when simulating for the impact of tariffs, Vale’s operations come under tremendous pressure.

Read more at: https://www.crugroup.com/en/communities/thought-leadership/2024/impact-of-us-tariffs-on-canadian-nickel-industry/